We hope you are doing well and have had a great spring. We are making some changes in your investment accounts and wanted to send you a brief update explaining the changes.

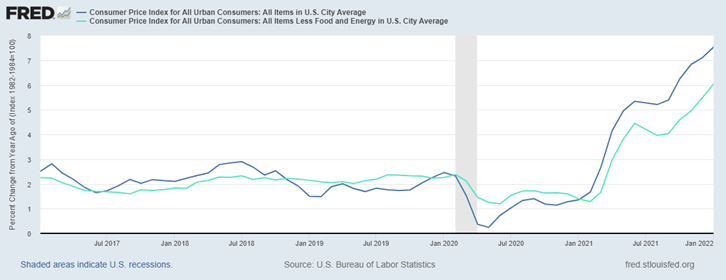

On the equity side of the portfolios, this year has been a better year than last but as inflation has persisted, the Federal Reserve has continued to raise rates (albeit at a slower pace than last year), and a continued “worry” about a potential recession, equities have begun to stagnate and move sideways.

As you are aware, we strive to use best in class funds in all of your accounts. One of our large value funds has slipped out of the top of its peer group and in our investment committee meeting this month we decided to sell this fund. This position represents anywhere from 2.58% to 10%[i] of the overall equity allocation in your account. We sold this position in your account on Friday and you may have noticed the trade confirmation.

Once the decision to sell this position was made, we turned our attention to where to go with this portion of the equity allocation. With the equity markets moving sideways, the risks associated with a potential recession along with other head winds in the equity market, we have decided to move this position in your equity allocation to the 30 day US Treasury-Bill (T-Bills)[ii] (see next paragraph for more information on this short term T-bill). We will continue to monitor the equity market to find an appropriate time to put this portion of the equity allocation back into the appropriate investment. In the meantime, the best answer seemed to be a decrease of the overall exposure to equities while earning historically significant treasury yields on the cash.

On the fixed income side of the portfolios, this year has been much better than last year, and yields on all the bond funds we are using have increased substantially. Currently, the bond allocation in your account is yielding approximately 5.14%[iii]. We will be making one change in the bond allocation. We are selling the Pimco Low Duration bond fund and replacing it with the Holbrook Income Fund. This is a relatively short-term corporate bond fund that has been in the top of its peer group. As we visited with the manager of this fund, they expressed that they are currently in a short duration posture but looking for opportunities to extend the duration once conditions are more favorable.

With the increase in interest rates, there has been an increase in the yield in short term US T-bills and even money market accounts. The money market account we use in your account is currently yielding 4.2%[iv] and the 30 day US T-bill is yielding in excess of 5.2%.[v] For this reason, we have decided to put all additional cash in all accounts, in excess of the 3% allocation to money markets, in the 30 day US T-bill. As these 30 day T-bills mature, we will continue to roll excess cash over to new 30 day T-bill until it is time to put the excess cash to work in other parts of the account. To the extent you have previously had us protect cash in your account we will not invest any of your protected cash and that cash will remain in the money market account.

To the extent you have cash “on the side lines” waiting to be put to work and would like that cash to earn in excess of 5.2%, please let us know, and we can arrange to have that cash moved into your Fidelity account and added to the 30 day US T-bill trades we will be making over the next few days.

As always, please do not hesitate to reach out should you have any questions or comments.

[i] Percentage of equity allocation in a portfolio is based on the overall risk tolerance

[ii] T-Bill is a short-term U.S, government debt obligation backed by the Treasury Department with a maturity of one year or less.

[iii] Calculation is based as of May 10th, 2023 by taking each of our bond holding funds SEC 30-Day yield (current yield) multiplying it by its portfolio weight to get its weighted yield and adding those weighted yields up to get the our bond allocation’s current yield.

[iv] FDRXX as of close of market on May 10th, 2023

[v] https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_bill_rates&field_tdr_date_value=2023